Leave a Lasting Impact for the Adirondacks

By joining our Legacy Family, you are forming an enduring partnership with the only community foundation serving the entire Adirondack region and providing hope and possibility to future generations. While we can’t know what the needs of tomorrow will be, by including Adirondack Foundation in your estate planning, your foresight will ensure that the communities and causes you care about today will be supported down the road, beyond your lifetime.

We are grateful for our Legacy Family members who entrust us to see their legacies through – whether by a named fund or supporting Generous Acts. A legacy gift and the lasting benefits it provides is profoundly meaningful and deeply personal. We’re here to help you envision the possibilities for giving back...

How We Can Work to Get Started

We are committed to building dedicated philanthropic resources for our community – and when you leave behind a legacy, you help us strengthen our investment in the people and communities of the Adirondacks. Whether you’re in the midst of planning your estate or simply brainstorming the possibilities, here are three easy steps to help you get started…

-

Let's Talk

Our team is ready to discuss your charitable interests and goals, how you can structure a gift, and where you can direct it for maximum impact.

-

Consult with your Advisors

Some donors start a charitable fund to enjoy grantmaking during their lifetime. Others defer their giving through estate planning. We’re here to collaborate with you and your advisor to tailor a gift that works for you.

-

Make a Promise

Complete a placeholder agreement that defines the purpose of your gift and/or fund and Adirondack Foundation’s responsibilities. The agreement is activated when the first gift arrives.

Testimonial Section

Making my planned gift to the Foundation was both easy to do and rewarding. I could do it without affecting current income and I knew that it would benefit Adirondackers for years to come.

Dick Strowger

Adirondack Foundation Trustee

1. Leave a Bequest

Include the Foundation in your will as the beneficiary of assets you wish to donate. Committing a portion of your bequest in this way removes the assets from your taxable estate. These can be cash, stocks, bonds, real estate, non-publicly traded or privately held stock, tangible property, or any of the possibilities described below. See our sample bequest language here.

2. Retirement Funds + IRAs

Name the Foundation as a beneficiary of your IRA, 401(k), or 403(b). Doing so can help to avoid income and estate taxes upon your death. Benefit your favorite causes and continue to withdraw from your plan during your lifetime.

If you are at least 70.5 years old, you can give a Qualified Charitable Distribution (QCD) up to $100,000 directly to a charity annually. If you have reached the age of 72, you can offset the taxes associated with a Required Minimum Deduction (RMD) with a direct gift to charity of up to $100,000 (Note: the RMD was waived entirely in 2020 by the CARES Act).

3. Life Insurance

Pay an annual premium for a new or existing life insurance policy and designate the Foundation as the primary or contingent beneficiary. You can also gift a life insurance policy you own and no longer need or make the Foundation the owner of a new policy for which you pay the annual premiums.

4. Charitable Trusts

A charitable remainder trust (CRT) ensures you have a stream of income for a designated time, after which the trust’s allocations are gifted to the Foundation, while a charitable lead trust (CLT) distributes a gift to the Foundation upfront for a specific period, after which the remainder transfers to named beneficiaries. Both a CRT and a CLT can be set up as an annuity or unitrust, the difference being that, annually, an annuity will pay out a fixed dollar amount to the lead beneficiary and a unitrust a fixed percentage. We recommend consulting with your advisors.

5. Replace Gifted Assets

Used in combination with a Charitable Remainder Trust, you can use a portion from the trust’s annual income to pay premiums on a life insurance policy or to replace the assets used to start the trust at its onset.

-

As your philanthropic partners, we work closely with investment consultants and manage permanent fund assets to grow over the long term. All legal, tax, and administrative requirements are handled by Adirondack Foundation in compliance with IRS regulations and national standards for community foundations. You can have confidence that your charitable dollars will be well managed for today and future generations, and that your charitable intentions will be ardently honored.

-

Once a donor has decided on the vehicle for their legacy gift, we work with you and your advisors to structure a tax-wise gift tailored to your vision. For some donors, that means starting a charitable fund right away and seeing the impact of their grantmaking during their lifetimes through a donor advised fund. For others, it means making provisions for a planned gift or end-of-life gift as part of their estate plan. In all circumstances, we encourage you to discuss your options with your professional advisors and wealth managers.

From there, we work together to craft a fund agreement or “placeholder” agreement – the latter for gifts that will arrive in the future – that identifies the purpose of your fund or gift and Adirondack Foundation’s responsibilities. The agreement is activated when the first gift arrives. At any time, you may change the charitable causes your fund will support without changing your will or other giving document – and you or anyone else can make additional gifts to your fund.

-

Generous Acts at Adirondack Foundation is the best place to direct unrestricted gifts. Because Generous Acts responds to pressing needs and invests in long-lasting systems change, your gift will never become obsolete. Similarly, establishing an unrestricted fund in your own name could do the same. If you prefer to narrow your support to a defined cause or place, you may want to consider a field-of-interest fund. We can help facilitate and scale customized philanthropic strategies – and unrestricted giving provides the greatest degree of flexibility to be able to meet the unknown needs of tomorrow. See other helpful sample language here.

-

You can use the following sample language: “I bequeath (amount, percentage, an asset) to Adirondack Foundation, a New York nonprofit corporation with EIN# 16-1535724, for (your gift’s purpose or placeholder/fund name).”

-

An investment in Adirondack Foundation is an investment in the future of our Adirondack communities. By joining our Legacy Family, your generosity will combine with that of others, grow exponentially over time, and ensure that we can adapt and respond to changing needs effectively and efficiently.

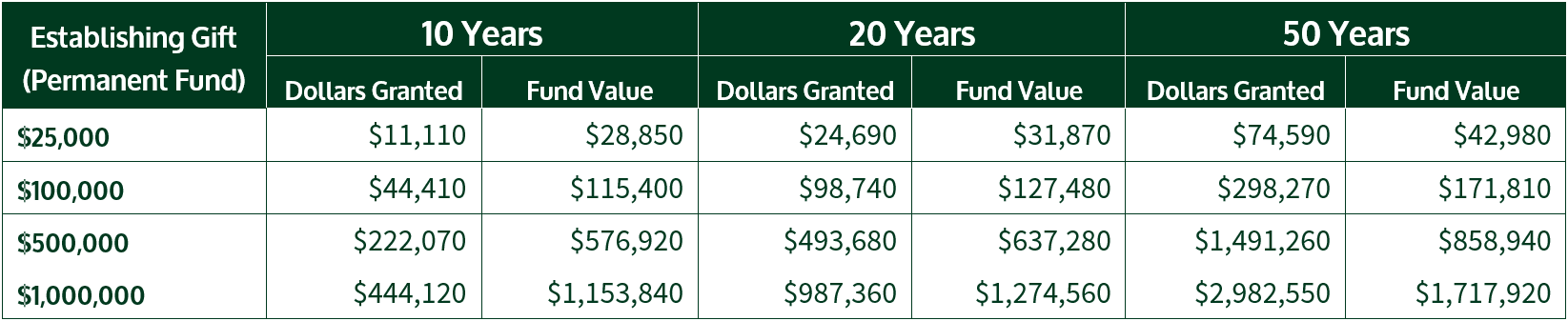

Here's a glimpse into the potential long-term impact investments in the Foundation can have over time for our communities.

Estimate of Cumulative Grants is based on Adirondack Foundation's Spending Policy (4.5% of the trailing 12 Quarter average market value). Fund Values have been estimated using a conservative annual return of 6.5%.